Discount in Accounting: A Comprehensive Guide

Introduction

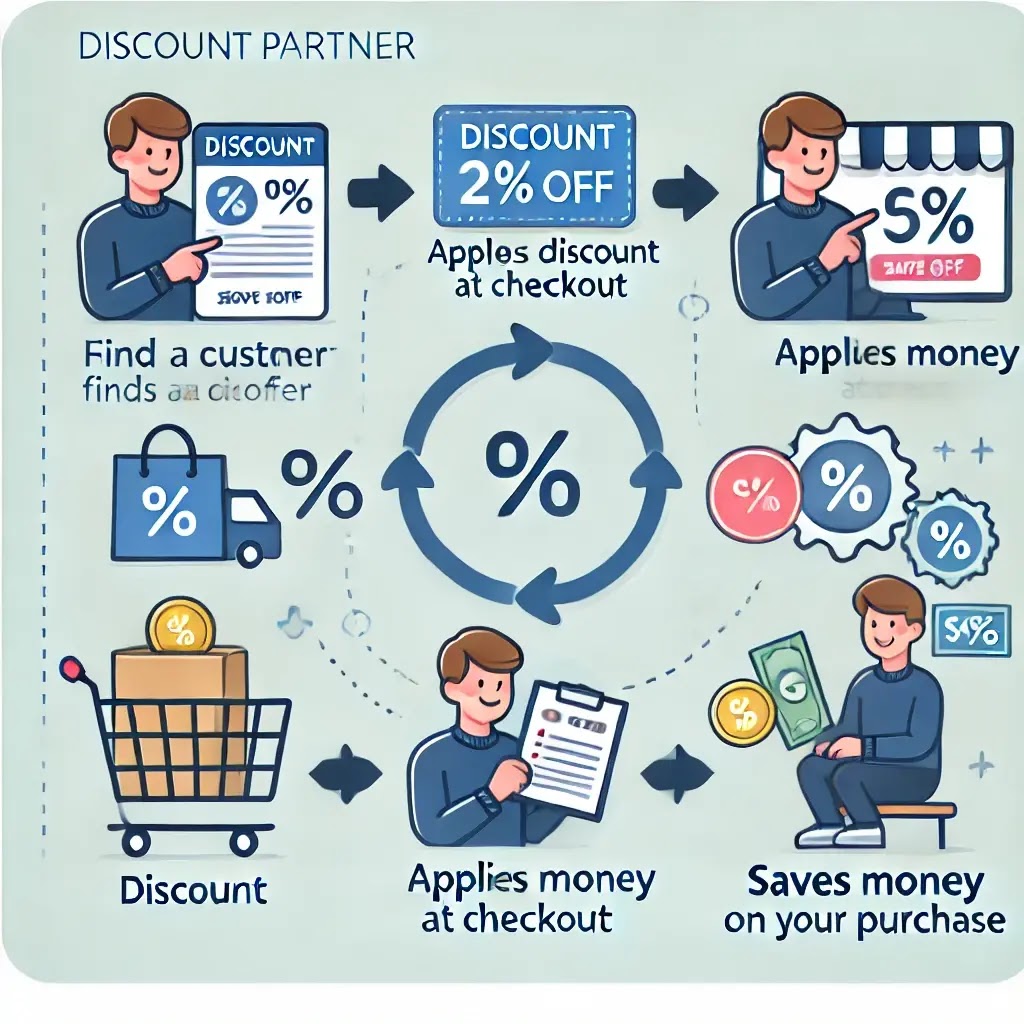

Discounts play a crucial role in accounting and business transactions. They are used to attract customers, encourage prompt payments, and build long-term relationships. In accounting, discounts affect financial statements, revenue recognition, and tax calculations.

What is a Discount in Accounting?

A discount in accounting refers to a reduction in the price of a product or service. It is usually offered to customers for various reasons, such as bulk purchases, early payments, or promotional purposes. Discounts impact revenue and expenses, making them an essential part of financial reporting.

Types of Discounts in Accounting

There are two major types of discounts in accounting:

- Trade Discount

- Cash Discount

Each type serves a different purpose and is treated differently in financial records.

1.Trade Discount

A trade discount is a price reduction given to customers at the time of purchase. It is usually based on the volume of goods purchased or a promotional offer. Trade discounts are common in wholesale transactions.

Characteristics of Trade Discounts:

- Offered before the sale is recorded.

- Not shown in the books of accounts.

- The discount is deducted directly from the listed price.

Example of Trade Discount:

A company sells 1,000 units of a product at $10 per unit. However, it offers a 10% trade discount on bulk purchases.

List Price: 1,000 × $10 = $10,000

Trade Discount (10%): $10,000 × 10% = $1,000

Net Selling Price: $10,000 – $1,000 = $9,000

In accounting, the revenue recorded will be $9,000. The trade discount of $1,000 will not be recorded separately in the books.

1. Cash Discount

A cash discount is a reduction in price offered to customers who make prompt payments. It encourages early payment and improves cash flow. Unlike trade discounts, cash discounts are recorded in accounting books.

Characteristics of Cash Discounts:

- Offered for early payment.

- Appears in financial records as a separate line item.

- Can be recorded as an expense or revenue.

Example of Cash Discount:

A company sells goods worth $5,000 to a customer with payment terms 2/10, net 30. This means:

A 2% discount is available if payment is made within 10 days.

Full payment is due in 30 days.

If the customer pays within 10 days:

Discount Amount: $5,000 × 2% = $100

Net Payment: $5,000 – $100 = $4,900

Accounting Entries for Cash Discount:

If the customer pays within 10 days:

- At the time of sale:

Accounts Receivable $5,000

Sales Revenue $5,000

When the customer makes an early payment:

The sales discount of $100 is recorded as an expense.

Other Types of Discounts in Accounting

Seasonal Discounts

Offered during a specific time of the year to boost sales. Example: Holiday discounts or off-season sales.

Quantity Discounts

Given for bulk purchases, similar to trade discounts but may apply even after the initial sale.

Promotional Discounts

Temporary price reductions to attract new customers or promote a new product.

Impact of Discounts on Financial Statements

- Income Statement

- Balance Sheet

- Trade discounts affect inventory valuation.

- Cash discounts impact accounts receivable and cash flow.

- Cash Flow Statement

- Discounts improve cash flow by encouraging early payments.

- Excessive discounts may reduce profit margins.

Trade discounts do not appear in financial statements.

Cash discounts are recorded as expenses, reducing net income.

Discount Accounting in Different Accounting Methods

- Accrual Basis Accounting

- Sales and discounts are recorded when the transaction occurs.

- Cash discounts are recorded when granted.

- Cash Basis Accounting

- Sales are recorded only when cash is received.

- Discounts are considered at the time of payment.